Vendors Fee Assessments

Eliminate the confusion and reduce your risk

Analyzing your plan’s fees for reasonableness can drain your time, money, and resources, and leave you exposed to a serious legal liability if not done properly.

Roland|Criss’ vendor compensation team is the perfect source for achieving the assurance you need for complying with the the law and earning your exemption from a key fiduciary responsibility.

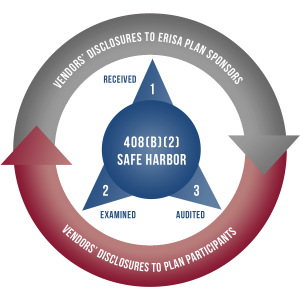

Compliance with ERISA changed dramatically when the U.S. Department of Labor released Regulation 408(b)(2). The so-called “Fee Disclosure” rule, it created the need for a new kind of unbiased expert. The Regulation offers a “safe harbor” exemption from breach of fiduciary duty, but obtaining it is not automatic nor is it easy for the unskilled and inexperienced.

What must plan sponsors do?

In order to earn the safe harbor exemption, ERISA plan sponsors are required by the Regulation to prove they have followed three steps:

1. receive fee disclosures from vendors

2. examine the disclosures for adequacy; and

3. prove that fees are reasonable (assessment and opinion).

With relief from a serious ERISA liability at stake, many plan sponsors are asking for help from a specially trained and experienced independent expert.

How can Roland|Criss help?

Roland|Criss’ ERISA Fee Assessment allows for the objective examination of key vendor management practices, vendor agreements, and vendor effectiveness. The assessment report contains a legally defensible opinion about the reasonableness of an ERISA plan’s fees.

Moving beyond mere fee benchmarking, Roland|Criss pioneered the Vendor Value Index™. The “VVI”” is the first viable metric in the industry to measure the value that employees receive for the fees they pay their retirement plans’ service providers.

The Vendor Value Index is embedded in our methodology. It empowers Roland|Criss as an indispensable compliance resource, guiding plan sponsors to a vital safe harbor.

Contact us

800-440-3457

Online inquiries

Vendor Value Index and VVI are trademarks of Roland|Criss Fiduciary Services