Tip for April 2017

Corporate risk tied to employee benefit plans is escalating, refocusing the pursuit of excellence from program features to risk management.

Many businesses and nonprofit organizations are changing their risk management systems in an attempt to meet these increasing risks head-on.

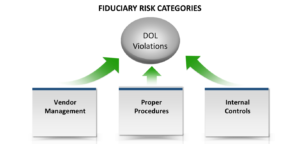

This TIPs issue identifies the three most common flaws that trigger fiduciary problems for sponsors of ERISA qualified benefit plans, and outlines a compliance framework for reducing legal risk, providing confident assurance, and promoting stewardship excellence.

Three Common Traits of Fiduciary Risk

The U.S. Department of Labor, which regulates employee benefit plans qualified under the Employee Retirement Income Security Act (ERISA”) has identified three of the most common causes of fiduciary violations.

Within each of the three risk categories, this TIPs provides a summary of practical strategies for protecting an organization against regulatory risk and serving as a confident steward of their employees’ assets.

But first, what does a mistake in these areas cost an organization? ERISA violations that are discovered through a DOL retirement plan audit can result in significant monetary penalties.

TIPs:

Vendor Management

Failing to properly select and monitor service providers is a major catalyst for class action lawsuits against ERISA plan sponsors and their key executives. A fairly simple approach will reduce the risk of become an easy target for claims. Be sure that your vendor oversight strategy embraces the following steps:

- Confirm that you’ve received each vendor’s most recent ERISA Section 408(b)(2) fee disclosure on a regular, timely schedule.

- Examine these vendor disclosures for adequacy and request clarification where needed.

- Prove that vendor fees are reasonable through a third-party assessment.

- Engage in an annual vendor value examination to ensure vendor service quality aligns with vendor fees. (An example of a third-party vendor assessment is Roland|Criss’ Vendor Value Index™).

Proper Procedures

Under ERISA, employee benefit plan managers must ensure that their decision-making and operations management follow a “prudent process.” Such a process is not merely an attitude; ERISA requires that it be evidenced by written procedures.

Although the subject of “procedures” is rarely a tantalizing one, it is particularly vital in the arena of retirement plan management as it drives alignment with critical fiduciary standards of care.

For plan sponsors seeking to ensure their current practices align with fiduciary requirements under ERISA, an independent third-party ERISA Governance, Risk Management, and Compliance (“GRC”) consultant can provide a prudent process template – or walk hand-in-hand to implement the entire process – that has the ability to instantly upgrade an organization’s fiduciary standing and secure stewardship peace of mind.

Internal Controls

In today’s world, an ERISA based GRC system of internal controls is a risk management imperative. Indeed, with proper internal controls in place, fiduciary risks #1 and #2 discussed in this article (vendor management and proper procedures, respectively) can be simultaneously and proactively addressed. An internal controls system for an employee benefit plan management process follows three primary steps to implementation:

- Conduct an assessment

- Consolidate key data sources

- Define control steps.

The road to fiduciary excellence can be easily navigated with the right companions along for the ride.

For more fiduciary tools, templates, and tips, contact Roland|Criss