Caution: The annual financial audit performed by a plan’s CPA won’t necessarily catch all payroll deficiencies that might exist. A CPA’s audit is focused primarily on financial transactions, not operational processes.

It’s vital to self-test periodically all of your plan’s payroll dependencies.

-

Definition of Compensation

Cause: The ERISA plan’s definition of compensation was not used correctly for all participants’ deferrals and allocations.

Cure: Fixing the deficiency can require corrective contributions, reallocations, and distributions.

-

Matching Contributions

Cause: Employer matching contributions weren’t made to all appropriate employees.

Cure: Apply a reasonable correction method that puts affected participants in the same position they would have been in if matching contributions were made to eligible employees in accordance with plan terms.

-

Elective Deferrals

Cause: Eligible employees weren’t given the opportunity to make an “elective deferral” election.

Cure: The employer makes a qualified nonelective contribution for any employee that misses the deferral opportunity.

-

Participant Loans

Cause: Participant loans didn’t conform to the requirements of the plan document and were, therefore, prohibited transactions.

Cure: Correct the repayment transactions and be sure to test the tax related impact on affected participants.

-

Hardship Distributions

Cause: A distribution is not considered necessary to satisfy an immediate and heavy financial need of an employee if the employee has other resources available to meet the need, including assets of the employee’s spouse and minor children.

Cure: Participants that receive unauthorized distributions are required to return their hardship distribution amounts plus earnings.

-

Timely Deposits of Deferrals

Cause: U.S. Department of Labor rules require employers deposit deferrals to the trust as soon as the employer can. Belief in a “safe harbor” deadline is a myth.

Cure: The employer submits a notification of its violation through the DOL’s Voluntary Fiduciary Correction Program.

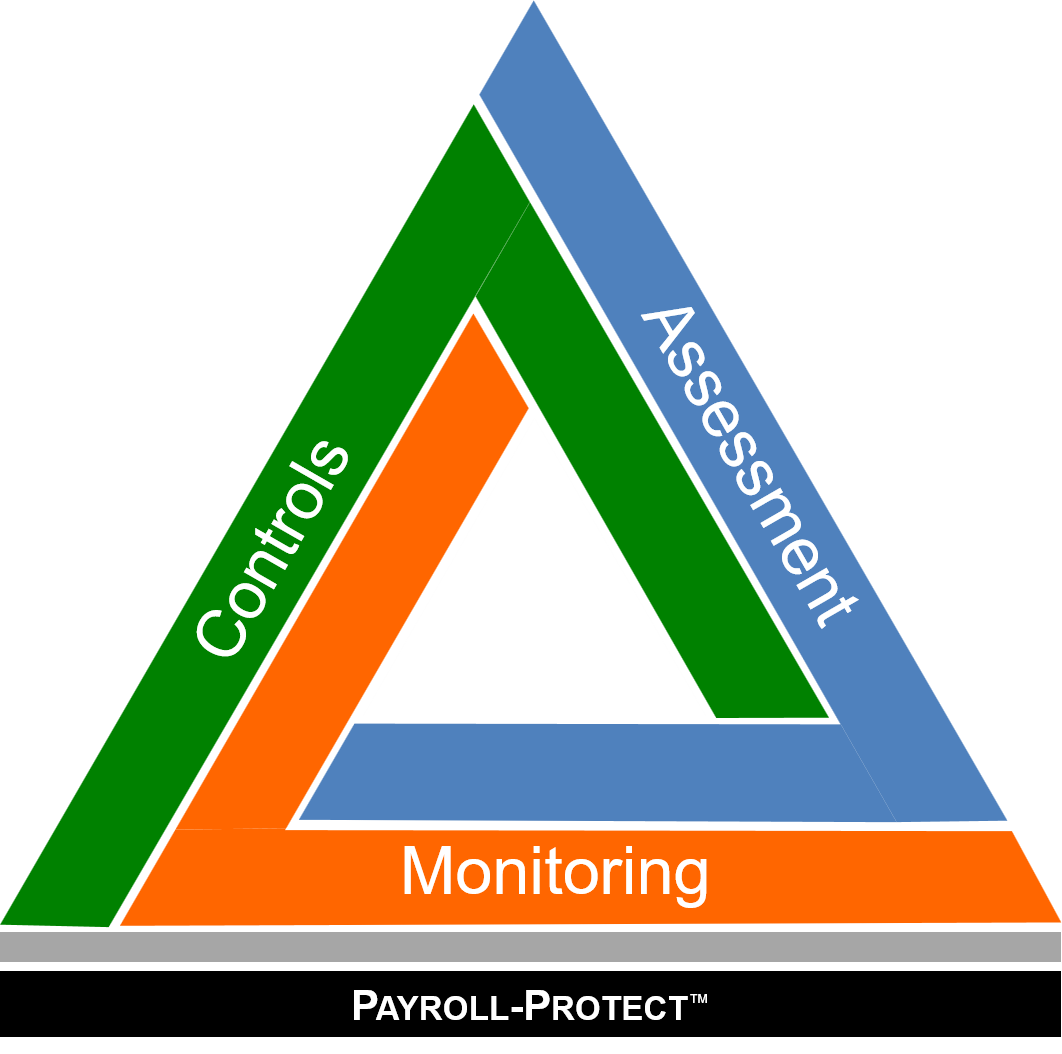

Our Payroll-Protect™ program helps clients implement a payroll controls framework; assesses operations against the controls; and establishes monitoring steps to ensure safety.

Our Payroll-Protect™ program helps clients implement a payroll controls framework; assesses operations against the controls; and establishes monitoring steps to ensure safety.

Payroll-Protect™ is a trademark of Roland|Criss.